Get Inspired

Upcoming Events

Spring Bridal Sale

26 Apr to 28 Apr 2024

Wedding Showcase @ Trim Castle Hotel

27 Apr 2024

Wedding Fair

28 Apr 2024

Wedding Open Day

28 Apr 2024

Boyne Hill House Estate - Showcase Sunday the 28th of April

28 Apr 2024

Wedding Showcase

28 Apr 2024

Riverside Park Hotel Wedding Showcase

28 Apr 2024

Wedding Showcase

28 Apr 2024

Wedding Showcase at Clontarf Castle

28 Apr 2024

Bridge House Hotel Spring Wedding Showcase

28 Apr 2024

<

>

Current Competitions

Win a Wellness Activity for your Hen Party or Bridal Party

22 Apr to 29 Apr 2024

WIN Afternoon Tea at Award Winning Barberstown Castle

8 Apr to 22 Apr 2024

WIN a romantic stay in The Hillgrove Hotel with dinner and spa treatments

1 Apr to 15 Apr 2024

WIN A Luxury Stay At Radisson Blu St. Helen’s Hotel

25 Mar to 1 Apr 2024

WIN a Romantic 2 Night Stay with Dinner at the McWilliam Park Hotel

19 Mar to 27 Mar 2024

Win a romantic stay at Thomas Prior Hall at Clayton Hotel Ballsbridge with dinner and wine

4 Mar to 18 Mar 2024

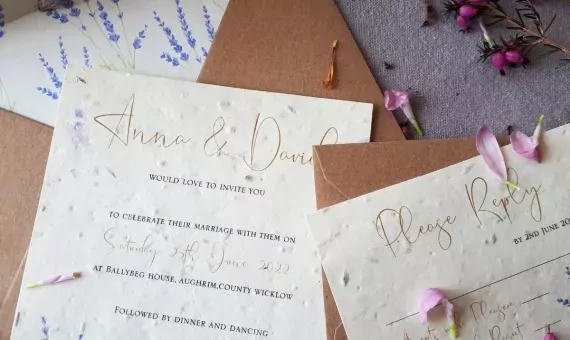

Win a €150 voucher for wedding invitations from Coill Design

4 Mar to 18 Mar 2024

WIN A Romantic Stay In Bridge House Hotel's Bridal Suite with Dinner

26 Feb to 4 Mar 2024

WIN The ICON Photo & Video Booth for your wedding from EntertainYou.ie

19 Feb to 26 Feb 2024

WIN a luxury stay at Dunboyne Castle Hotel & Spa

19 Feb to 26 Feb 2024

<

>

Are you sure?

This action cannot be undone