Get Inspired

Upcoming Events

Seasons of Sinatra - Summer

17 May 2024

The Wilful Live

18 May 2024

Wedding afternoon venue showcase

19 May 2024

Spring Wedding Fair

19 May 2024

Boyne Hill House Estate - Showcase Sunday the 19th of May

19 May 2024

The Wilful Live

19 May 2024

The Bentley Boys - Live Dublin Showcase

20 May 2024

Wedding Viewing Evening

22 May 2024

Bride Chiller: Celebrant Wellbeing Tips

22 May 2024

Anner Hotel Wedding Viewing Evening

23 May 2024

<

>

Current Competitions

WIN a luxury handfasting cord by Anamchara worth €135

6 May to 20 May 2024

WIN a Romantic 2 Night Stay with 1 Dinner at the Diamond Coast Hotel, Enniscrone

13 May to 20 May 2024

WIN A Full Set of Cascata Hair - Luxury Seamless Clip In Hair Extensions

29 Apr to 13 May 2024

Win a Wellness Activity for your Hen Party or Bridal Party

22 Apr to 6 May 2024

WIN Afternoon Tea at Award Winning Barberstown Castle

8 Apr to 22 Apr 2024

WIN a romantic stay in The Hillgrove Hotel with dinner and spa treatments

1 Apr to 15 Apr 2024

WIN A Luxury Stay At Radisson Blu St. Helen’s Hotel

25 Mar to 1 Apr 2024

WIN a Romantic 2 Night Stay with Dinner at the McWilliam Park Hotel

19 Mar to 27 Mar 2024

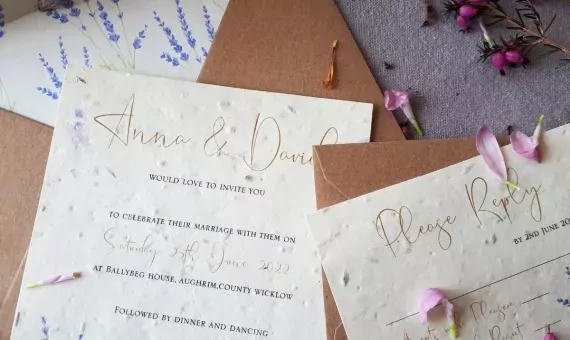

Win a €150 voucher for wedding invitations from Coill Design

4 Mar to 18 Mar 2024

Win a romantic stay at Thomas Prior Hall at Clayton Hotel Ballsbridge with dinner and wine

4 Mar to 18 Mar 2024

<

>

Are you sure?

This action cannot be undone